Innovative Gibraltar-based lending platform and fintech startup, Lendingblock has recently been granted a Distributed Ledger Technology Provider licence by the Gibraltar Financial Services Commission. Seeking to set a new benchmark and industry standard in crypto, Lendingblock recently created the first Global Digital Assets Lending Agreement (GDALA).

Lendingblock believes it can mirror the traditional financial lending market by supporting shorter-term trading, hedging and working capital needs. It is aiming to raise the bar and set the industry standard in the digital assets market. Fintech.gi met it’s CEO and Founder, Steve Swain at Lendingblock’s World Trade Center HQ to ask him why he’s so invested in regulation, his plans for the brand and how he sees the wider market developing.

What is Lendingblock?

“Lendingblock has been founded on the mission of reinventing securities lending or repo in traditional capital markets and delivering what is a scalable, secured lending platform to the digital asset economy. Creating this very mature and very important basic financial service that exists in conventional markets, and tailoring it to crypto markets, is crucial, as according to Lendingblock , the same things that drive borrowing and lending of securities in debt and equity markets apply equally to digital assets.

What we’re trying to do is to say that there is a need for this type of service, but with the opportunity to design and to find something on a blank sheet of paper, so you can take something which clearly works in conventional markets, but do so in a very innovative way.”

Why did you decide to set up from scratch?

“In life you very rarely get the chance to do something genuinely innovative. I had a career in investment banking and consulting where I was fortunate enough to be quite successful. Ultimately, you’re still part of a very large machine and even within those constraints, trying to do something genuinely innovative is quite difficult. For me, this was an opportunity, almost like a final career act, to be able to take what I’d learned before and apply it to a new emerging economy. I have the benefit of applying all that I have learned and experienced in the past to create something new. Also, the pace of which things happen and get done is also tremendously stimulating. As the industry matures, I think that it is all going to slow down and become more normalized. We’re enjoying the heyday at the moment.”

What makes Lendingblock different to other crypto financial services?

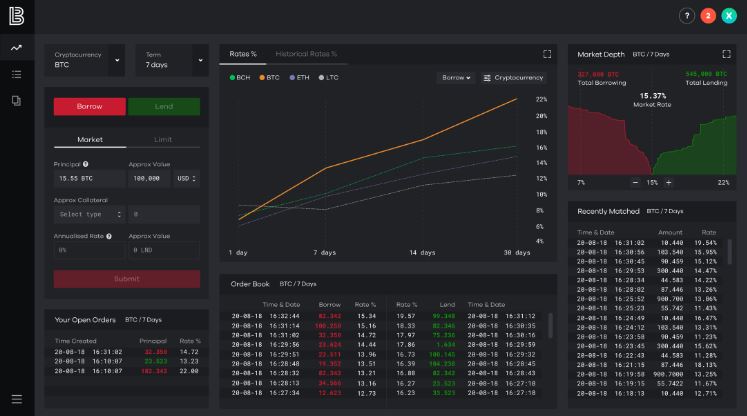

“If you look at the lending market, there are businesses which are very focused on the retail market. We are very much institutional rather than retail. Our clients include exchanges and funds and trading firms for example. I think within that, you can also look at what’s automated, versus what’s a manual process. Most of the lending that happens at the moment in the institutional space, is just guys in a room doing deals. What we’re bringing is something which is not only institutional but also also fully automated and fully technology-based. This means that it’s a platform that has a high degree of scalability and an opportunity to become commoditised. We differentiate ourselves on the basis of being institutional focused and being a platform.”

How are you setting yourselves apart from the competition?

“I think brand is incredibly important. We’ve been very clear that from day one. We position ourselves as central to the developing out a trusted broader financial ecosystem for institutions dealing with cryptocurrencies. We’ve focused on what I think is a very clear message in all of our branding. We’re institutional. We’re serious and committed to the long term, and we’ve got a very strong focus on being a trusted part of market infrastructure development. Certainly, if you look at the crypto space, there are plenty of people whose marketing messages are all about ad establishment and disruption, and that is not our tactic. We are very much focused on an evolution and on creating a better financial system for all of our participants.”

What’s the potential growth of the crypto-financial services market?

“At the moment, we’re a very small piece of what is a very small market, that we think that that market will grow in size and we think that our share, the amount that’s used in securities lending the digital assets is going to grow tremendously.

“If you look at institutional securities lending, which is what we’re trying to bring into digital assets, in the US as an example, one in every eight shares, is used in securities lending at any point in time. That kind of gives you a benchmark of what’s possible, it’s about 12.5% of stocks are on use in securities financing. If you could say that the same things drive what’s happening in crypto market then the potential should be about 12.5% of the size of the crypto market. Where we are today, is about half a percent. We’re just scratching the surface of what we think the potential within the crypto space is. At the moment, we’re a very small piece of what is a very small market. We think that market will grow in size and we think that our share, the amount that’s used in securities lending the digital assets is going to grow tremendously.”

Are we seeing wider adoption crypto financial services across the financial services industry?

“We are definitely seeing toes being dipped in the water. Both through the kind of activity that’s public, but also the preparation that we can see behind the scenes. As an example of what’s public, we’ve seen Fidelity come out with a very clear strategy around crypto being an important part of their future and an important part of the future for their clients. That’s happening, but there are other big organizations who are making the same preparations behind the scenes. We’re very confident that over time, there will be a normalization and a convergence between digital assets and conventional financial markets. This theory underpins the strategy that we have for our business. And, it’s an important part of why we wanted to be here in Gibraltar and become regulated because we think this is going to be incredibly important for our clients in the future.”

Why was it important to gain your DLT trading license?

“I think it’s an endorsement of the way that we want to run our business, which is being consistent with the highest standards of transparency and having good governance. Because we want to be trusted by our institutional clients, and we have to be serious about the risks and the controls that we have in place to protect our platform’s market participants. Being regulated is an important representation of the company you are, and for us, this is vital.”

What does the licence mean for the company?

“I think it’s the start. It’s the start because the reality is that the regulatory landscape around crypto is still very much earlier stages of evolution. We have no doubt that over time there will be more clarity in the UK, in the US, and in parts of Asia for example. We will end up needing to become and wanting to become regulated in multiple jurisdictions around the globe. Gibraltar is a really good stepping stone for us because it allows us to put into place a set of policies and controls, which we think are very consistent with the expectations of regulators in other places, even though other countries are not as advanced yet. I’m of the view that getting regulated in Gibraltar is only just a starting point for us.”

How long has the process of gaining your licence taken?

“Well, it took about 15 months in total from start the process to obtaining the licence. As I look back on that, I think that’s actually a reasonable period of time to complete such a comprehensive process with the regulators. From a blank sheet of paper to a fully regulated business I think in 15 months is good. Now obviously what we’ve done in that time is not just about regulation. It’s also been just as important to develop the platform, build up a client base and create a legal framework behind what we do in order to bring an appropriate product that caters to the institutional market.”

What’s next for the firm?

“We’re licensed, which is a huge milestone for us, but the next important thing is to actually launch the platform and then start to see the clients that we have transacting across our loan markets. The short term focus is launching the business commercially and starting to see the initial clients transact on the platform; then, hopefully we’ll be in a good position to grow and expand what we do over the next year.”

Discover more about Lendingblock