Insurtech (insurance technology) is often described as a subset or division of Fintech. Insurtech refers to the fast-changing new technologies like DLT and Artificial Intelligence that are revolutionising the insurance industry. If you’ve renewed an insurance policy or shopped around for a cheaper premium recently, chances are you’ve already interacted with a chatbot, used a smartphone app or received a quotation based on machine-learning. That’s all part of insurtech.

While Gibraltar values the personal touch and we are all used to the quality service currently offered by insurance companies locally, our financial services sector is no stranger to innovation. Here’s the Fintech.gi list of the insurance industry’s top innovators, newcomers and disruptors.

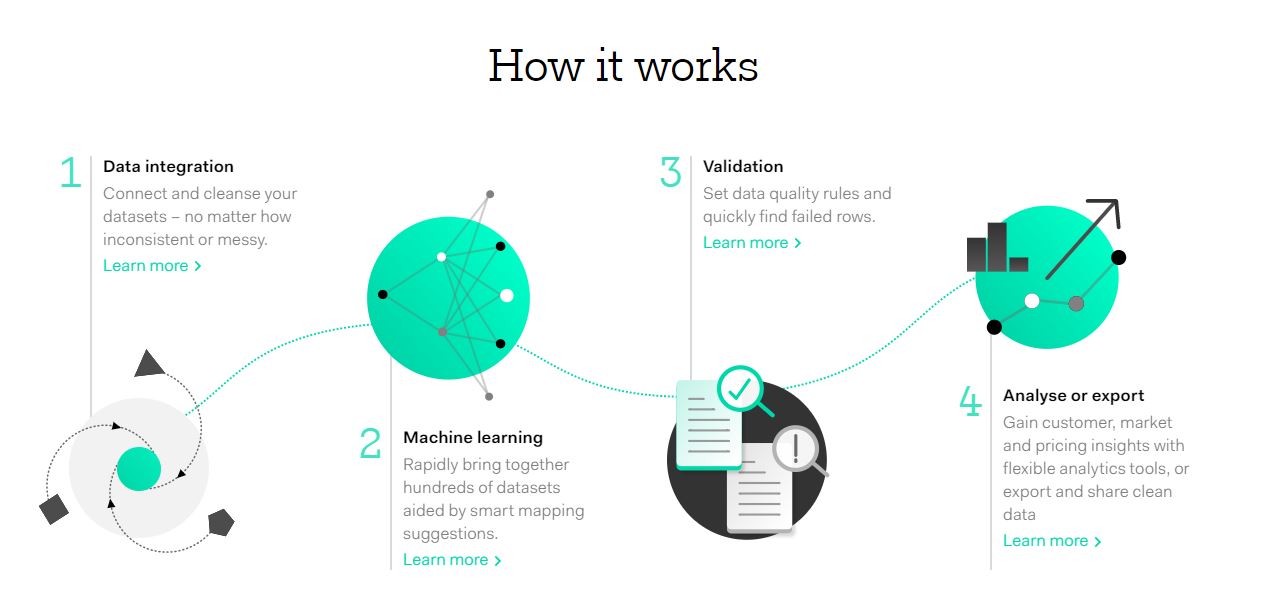

1: Quantemplate

Insurance industry newcomers, Quantemplate, is offering established insurance firms a platform through which to mine – and exploit – their data resources effectively. Their machine-learning-powered tools help them cleanse and harmonise raw data and use it to develop a competitive advantage, reduce costs and accelerate the adoption of new technologies. Founded in 2012 by friends Adrian Rands and Marek Nelken, the company has raised an impressive $26m in funding alone.

2: Slice Labs

2: Slice Labs

The demand for on-demand insurance continues to rise due to today’s ‘gig-economy’. Founded in 2015, Slice Labs describes itself as ‘the insurance engine behind tomorrow’s cloud-based, on-demand digital services ecosystems’. What this means is that insurers are now able to build intelligent and intuitive, pay-as-you-go digital insurance products that serve those individuals who need ad-hoc cover. They have achieved strong growth through a strategy of partnering with established insurance firms like AXA XL to build and launch innovative and individualised insurance products.

3: Allianz + Dinghy

Much like Slice Labs, UK-based Dinghy serves the self-employed, freelance sector with flexible business insurance. In December 2019 insurance mega provider Allianz announced a partnership with the firm in order to access what is a growing market segment. What this announcement also highlights is a wider industry-wide trend of larger, established firms many of whom are somewhat on the back foot in terms of technological innovation, turning to newcomers to accelerate their adoption of new technologies and tap new revenue streams.

4: Beam Dental

Smile! US-based dental insurance firm Beam Dental has combined the ‘Internet of Things’ with customer data to offer an original approach to their dental insurance product. All policyholders enjoy a subscription service that includes an internet-connected electric toothbrush, floss and toothpaste in order to promote – and track – their customer’s dental hygiene habits. They are rewarding customers for brushing their teeth and this preventative care approach is paying off – they have raised over $88m in funding so far.

5: Insurwave

5: Insurwave

The adoption of blockchain technology is gathering momentum across the world with many companies using it to manage data processes and logistical challenges more efficiently. EY and Guardtime recently created the world’s first blockchain-enabled insurance platform. Their ‘Insurwave’ project integrates and secures the streams of disparate data sources involved in insuring shipments around the world. The blockchain-enabled platform is automating the insurance process and aims to transform the world’s marine insurance industry. Benefits of using blockchain allowing faster claims processing, premiums agreed and settled in seconds and accurate, real-time tracking of assets and risk exposures.

Related story: A Beginner’s Guide on How to Speak FinTech