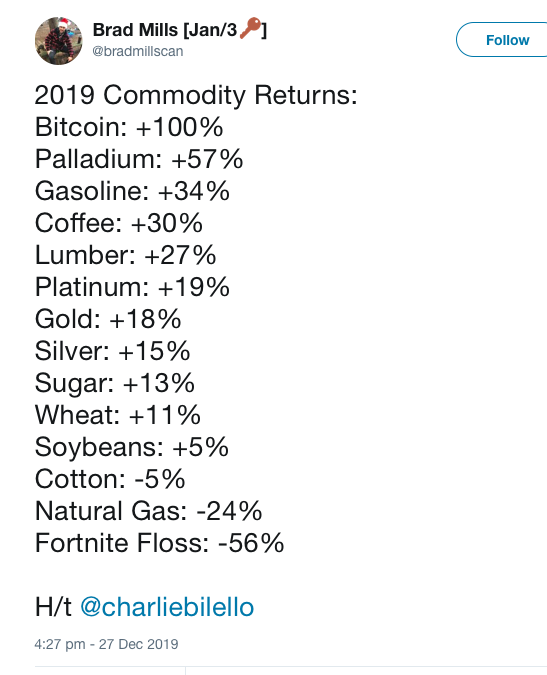

Bitcoin emerges as the world’s top performing asset in 2019, beating the figures for Palladium, US crude oil and nickel by a significant margin, as shown by statistics from Brad Mills using data compiled by Carlie Bilello of Compound Capital Advisors. Despite Palladium’s impressive performance with a return of 57%, Bitcoin, the world’s leading cryptocurrency, streaked into the lead coming close to doubling that.

Bitcoin tops asset performance in 2019 (Brad Mills)

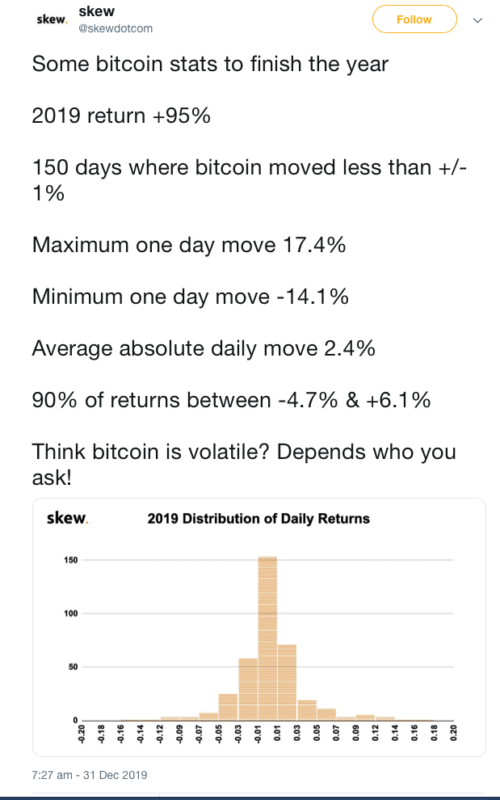

Although Bitcoin’s volatility had generally been off-putting to investors, in particular to institutional investors, during 2019 its volatility levels were markedly below those of 2018, with price changes, either downwards or upwards, varying by less than 1% during a period of 150 days, with the average daily move settling at around 2.4%. This is clearly shown in the graphic below, depicting an analysis posted by Skew Trading:

Skew Trading 2019 Bitcoin stats.

Bitcoin emerges ahead of gold and silver, performing better and defying suggestions from its critics that the metals are a better investment. This echoes comments made earlier during 2019 that Bitcoin could easily prove to be the “digital gold” of the twenty-first century, especially as younger generations of investors begin to mature and take over the investment mantle from Baby Boomers.

Analysts are furthermore suggesting that there might be a link between the price of Bitcoin to geopolitical turbulence as is the price of oil. Bitcoin’s value surged shortly after the the US strike on Iran’s General Qasem Soleimani. In the wake of the attack, a sluggish Bitcoin sharply picked up its price, soaring a sharp 4% to return to over $7,000. This could indicate that investors are expressing an increasing interest in cryptocurrency as a means of working through turbulence created by situations such as international tensions, the ongoing US fuelled trade war and Brexit uncertainties.

Regardless of Bitcoin’s performance in the face of worsening international relations, 2020 is expected to be an interesting year for the cryptocurrency. Not only does its rally in price in the first few days of the year, hot on the heels of its performance as a top asset in 2019, give reason for enthusiasm, but the halving event in May 2020 is likely to see a sharp upturn in price as Bitcoin becomes scarcer. Bitcoin continues to attract intense interest.